Schedule A Standard Deduction 2025 – There is good news from the IRS this year. The standard deduction that people are allowed to take has gone up. . With tax season underway, you’ll need to know the standard deduction amount you can claim for 2023. The standard deduction amounts tend to increase slightly each year to adjust for inflation. Let’s .

Schedule A Standard Deduction 2025

Source : www.forbes.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comIRS Announces 2025 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comTax brackets 2025| Planning for tax cuts | Fidelity

Source : www.fidelity.comYour First Look At 2025 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comWhat’s My 2025 Tax Bracket? | First Financial Group

Source : www.ffgadvisors.comYour First Look At 2025 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comStandard Deduction 2025 Amounts Are Here | Kiplinger

Source : www.kiplinger.comIRS Announces 2025 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comSETC 2025 | How To Claim Up To $32K: A Comprehensive Guide to the

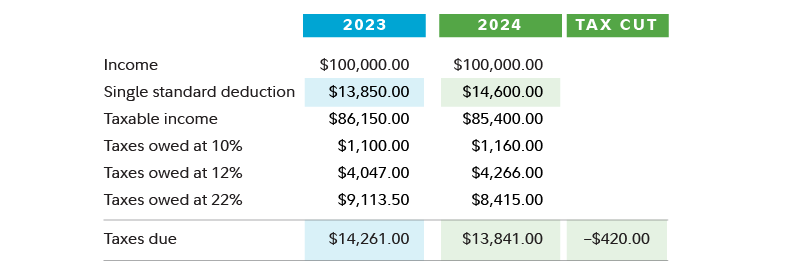

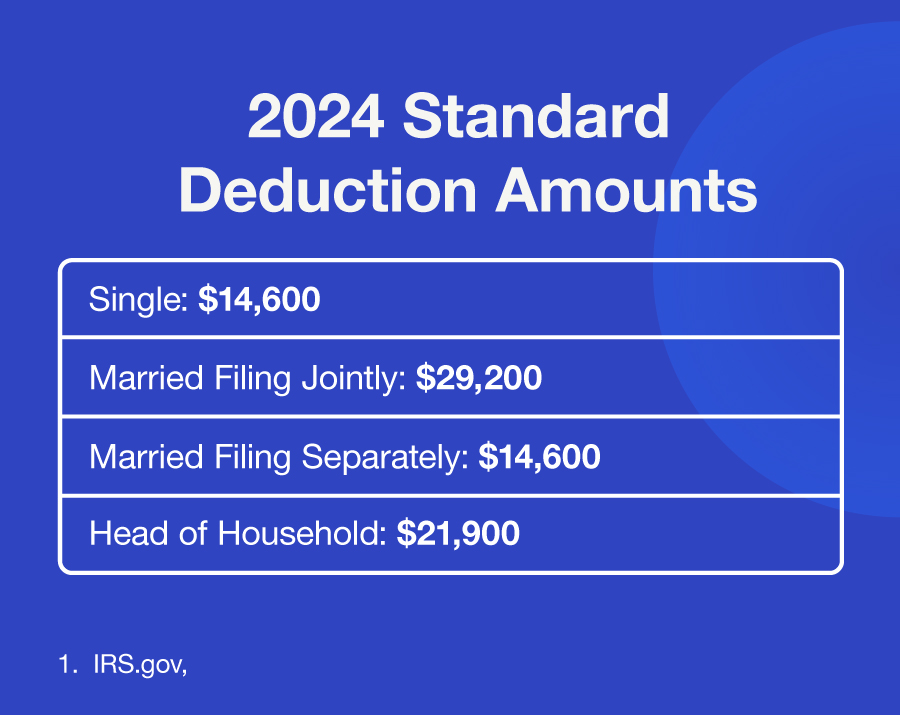

Source : blog.joshkingmadrid.comSchedule A Standard Deduction 2025 IRS Announces 2025 Tax Brackets, Standard Deductions And Other : For 2023, the standard deduction is $13,850 for married filing separately and In most cases, homeowners can report the amount on this form on line 8a of Schedule A (Form 1040). However, the . The legislation would have allowed some married couples in high-tax states to save on their Internal Revenue Service bills. .

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)